What Is Social Security Limit 2025. For earnings in 2025, this base is $168,600. You aren’t required to pay the social security tax on any income beyond the social security wage base limit.

The cola for 2025 was 3.2%, meaning beneficiaries received a 3.2% boost in benefits starting in january. If you will reach full retirement age in 2025, the limit on your earnings for the months before full retirement age is $59,520.

Social Security 2025 Limits Aili Lorine, Beyond that, you'll have $1 in social security withheld for every $2 of income from a job. The maximum social security benefit you can receive in 2025 ranges from $2,710 to $4,873 per month, depending on the age you retire.

Social Security Earnings Limit In 2025 Beckie Rachael, What is the social security tax limit? Use our retirement age calculator to find your full retirement age based on your date of birth.

Social Security 2025 Limits Aili Lorine, The earnings limit for workers who are younger than full retirement age (see full retirement age chart) will increase to $22,320. The limit is $22,320 in 2025.

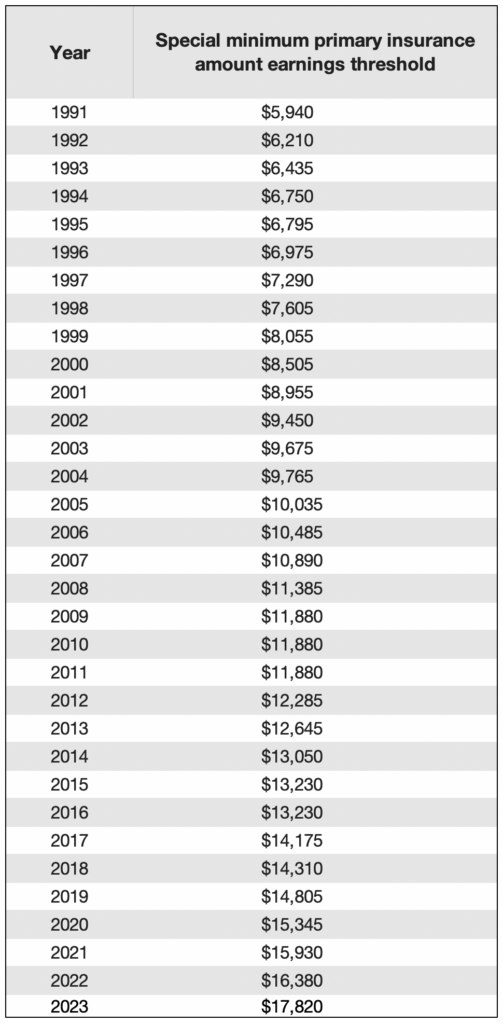

Limit For Maximum Social Security Tax 2025 Financial Samurai, For 2025, the amount of earnings that will have no effect on eligibility or benefits for ssi beneficiaries who are students under age 22 is $9,230 a year. The maximum earnings that are taxed have changed through the years as shown in the chart below.

How Much Will Ssi Recipients Receive In 2025 Rikki Christan, The maximum social security employer contribution will increase by $520.80 in 2025. This adjustment aims to help social security keep up with inflation over time.

2025 Social Security Limit YouTube, The highest social security retirement benefit for an individual starting benefits in 2025 is $4,873 per month, according to the social security administration. Step 2:look for the link labeled supervisor admit card 2025 and click on it.

Social Security Limit for 2025 Social Security Genius, So, if you earned more than $160,200 this last year, you won't have to pay the social. As a result, in 2025 you’ll pay no more than $10,453 ($168,600 x 6.2%) in social security taxes.

Social Security Limit On Earnings 2025 Wynny Karolina, Workers earning less than this limit pay a 6.2% tax on their earnings. But beyond that point, you'll have $1 in benefits withheld per $2 of earnings.

Social Security & Retirement 2025 Working & Receiving Social Security, What is the social security tax limit? The maximum social security benefit you can receive in 2025 ranges from $2,710 to $4,873 per month, depending on the age you retire.

What is the Minimum Social Security Benefit? Social Security Intelligence, The social security administration (ssa) announced that the maximum earnings subject to social security (oasdi) tax will increase from $160,200 to $168,600 in 2025 (an increase of $8,400). If your retirement plan involves falling back on social.

The amount of earnings that we can exclude each month, until we have excluded the maximum for the year, is $2,290 a month.